Money Mastery: A Confident Guide to Financial Freedom this is bast blog for you. Whether you are just starting out or trying to get your finances back on track, you are in the right place. This book is written to guide you in gaining confidence with money! No matter what your current situation is, we will walk through practical steps to manage your finances, save intentionally, invest wisely, and continuously work towards lasting financial freedom.

Chapter 1: The Mindset of Financial Confidence

Money Mastery: A Confident Guide to Financial Freedom finances are the catalyst for your purposefulness, and we aren’t taught from childhood that money is everything. We are molded the way we are in childhood. Financial confidence is built through learning and practice. If you feel like money is controlling you, you should try to distance yourself from money as quickly as possible. Start by becoming aware of your money habits and beliefs. Ask yourself: What stories have I heard about money since childhood? Do I associate money with stress or security? Understanding your emotions will help you gain control and start a new life.

Chapter 2: Building a Strong Financial Foundation

Money Mastery: A Confident Guide to Financial Freedom A strong financial foundation is built on three pillars: budgeting, tracking, and emergency savings.

Budgeting: Create a simple monthly plan for your income and expenses. Tools like the 50/30/20 rule (50% needs, 30% wants, 20% savings) make this easy.

Tracking: Keep track of where your money is going and how I’m spending it. One small mistake can sink a big ship.

Emergency fund: Build a fund to cover at least 2-5 months of living expenses. This will help you support your family and strengthen yourself when life throws you into a tailspin.

Table of Contents

Chapter 3: Smart Saving Strategies

Automate savings: Deposit the amount you plan to save each payday and don’t try to spend it all.

Set clear goals: Whether it’s a holiday or a smaller payment, having a purpose makes saving easier.

Use the right tools: High-yield savings accounts and budgeting apps help you grow your money and stay organized. If you feel that spending money is important, then spend it instead of spending it, because later you may feel that you made a big mistake in saving money (like someone in the family is sick, a good friend is in trouble, or your personal life is in trouble).

Chapter 4: Mastering Money Management

Money Mastery: A Confident Guide to Financial Freedom Money management is about staying in control, not feeling restricted.

Know your cash flow: Understand how much you earn and where you spend the most and start working on it

Use financial apps: Apps like Mint or YNAB (You Need a Budget) can help you track expenses and create better habits. And you can even make money online. It will show you a new path and you will know what is wrong with right

Plan for bills and debt: Set calendar reminders for due dates, and check back whenever possible to see if you’re saving money or spending more.

Chapter 4: Mastering Money Management

Money Mastery: A Confident Guide to Financial Freedom Debt can seem overwhelming, but there’s a way out of it.

Differentiate between debts: Not all debt is bad some (like mortgages) can sometimes be beneficial.

Choose a payment strategy: Use the snowball (smallest debt first) or avalanche (highest interest first) method.

Avoid new loans:Before taking more loans, pay attention to the existing loans which are outstanding on you and do not think of taking more loans because if you think of taking more loans then there are high chances that you may get into trouble and your family may also have to face problems.

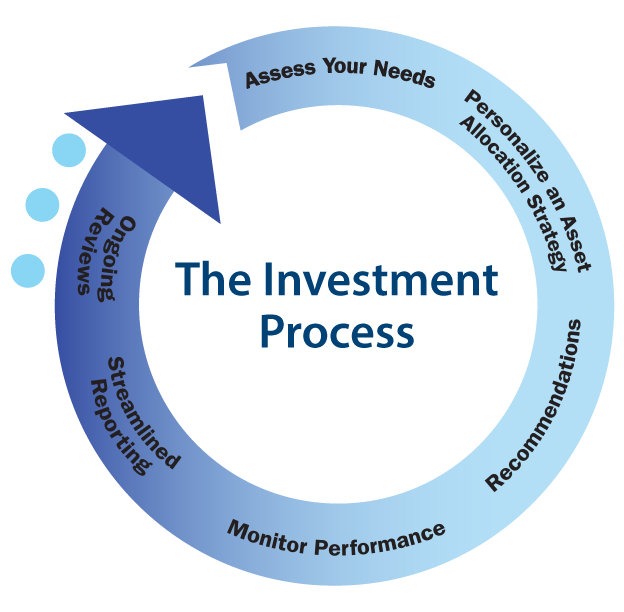

Chapter 6: Investing with Clarity and Confidence

Money Mastery: A Confident Guide to Financial Freedom Investing may seem scary, but it is a way to put your money on the right track and make it work for you (mutual funds are a good idea) and by starting a SIP (system investment plan) you can also get huge returns in the long term.

Start simple: Learn the basics stocks, bonds, mutual funds and index funds. And there are many other options available as well

Diversify: If you make long-term investments, you will definitely get profits like (Up stock, Grow, Angel One, Ind Money)

Chapter 7: Long-Term Wealth Creation

Money Mastery: A Confident Guide to Financial Freedom Wealth is not created overnight, nor does it ever happen like this. All the billionaires today have become so by working hard and applying the right method but the good news is that time is your biggest friend.

Plan for retirement early: The sooner you start, the sooner compound interest will work its magic and you’ll become a successful man.

Create passive income:Try to buy rental property, dividend-paying stocks or start a side business because in today’s time no one can become big by doing a job. Start some business which will make you very successful in the future.

Be persistent: Keep working continuously because if you don’t do this, you will be down and you will feel that I worked very hard but I could not achieve anything. Small steps become big

Chapter 8:Financial Freedom is a journey

Money Mastery: A Confident Guide to Financial Freedom Financial independence looks different for everyone. For some, it means retiring early. For others, it means not just living paycheck to paycheck.

Set your goals:What does financial independence mean to you? And nothing happens without goals. If you don’t know how to make goals, you can check out YouTube. Many people make videos on YouTube. You will get a plan from them on how to make small goals.

Create a roadmap:Keep working on what you are good at and you will definitely get success in it and use what you have learned to create a plan that suits your life.

Be flexible:Life changes. So should your plan. Review and modify it regularly.

Resources and Tools

- Books “Your Money or Your Life,” “The Simple Path to Wealth”

- Apps: Mint, YNAB, Personal Capital

- Websites: NerdWallet, Investopedia, Bogleheads.org

Conclusion

Money Mastery: A Confident Guide to Financial Freedom You’ve taken a powerful first step just by reading this. Now, keep going. Confidence with money doesn’t come from having a huge income it comes from knowing how to use what you have wisely. Keep learning, stay consistent, and remember : financial freedom is possible for you.

Your Next Steps:

Set one financial goal this week.

Open or review your budget.

Automate a savings transfer.

Let this book be your starting point to a lifetime of financial confidence and peace of mind.

Leave a Reply to 1 Apple iPhone 17 Pro Max Full Review (2025) Cancel reply